Decarbonization of Real Estate with Machine Learning

By Sara Memon

From The Wharton School

By using technology like machine learning and AI, property owners can swiftly reduce carbon emissions in their buildings. This involves assessing present heating and cooling systems, finding potential for solar or geothermal power, and identifying areas where insulation and efficiency necessitate improvements. Specialized algorithms can then suggest the best course of action for each building, as well as the entire portfolio, to achieve carbon neutrality within a specified timeframe. These tools can rapidly produce financially-optimized plans for each building based on its regulatory requirements, lease terms, and other characteristics.

Unlike traditional methods that rely on energy audits, which can be time-consuming and costly, this approach is more than 100-fold faster and wider in scope. It eliminates the use of generic building archetypes or cost curves, providing detailed plans that lead to quicker emission reduction without sacrificing profits. Real estate organizations can use this system to plan ahead, integrating decarbonization costs into decisions about acquiring or occupying buildings. With rapidly-generated plans, owners can strategically invest capital, coordinate procurement, design, and project management, minimizing overall costs.

The Onus on the Real Estate Industry

The real estate sector contributes to around 40% of global combustion-related emissions, with 28% attributed to building operations and 12% to embodied carbon (emissions from building materials and construction). To limit global warming to approximately 1.5°C and achieve a net-zero-carbon building stock by 2050, the International Energy Agency (IEA) suggests that direct building emissions, like those from onsite gas or oil boilers, must be cut by 50%, and indirect emissions, achieved through energy efficiency measures and grid decarbonization, should be reduced by 60% by 2030.

Present efforts have been and are continuing to be made that push towards net-zero emission commitments. On a global scale, regulatory bodies are actively engaging in strategizing to address the ecological footprint left by the real estate industry. Noteworthy among these measures includes the European Commission's Energy Performance of Buildings Directive, which is designed to elevate the energy efficiency standards of buildings across Europe through streamlined investment parameters. In the United Kingdom, comparable efforts are being undertaken through the implementation of the Minimum Energy Efficiency Standards, a set of regulations aimed at promoting energy-efficiency primarily to landlords. Concurrently, the United States Securities and Exchange Commission proactively proposes climate disclosure requirements, underscoring a commitment to transparency of climate-related risks. These initiatives collectively underscore a global commitment to sustainability within the fabric of the real estate industry.

Projected Profitability Margins

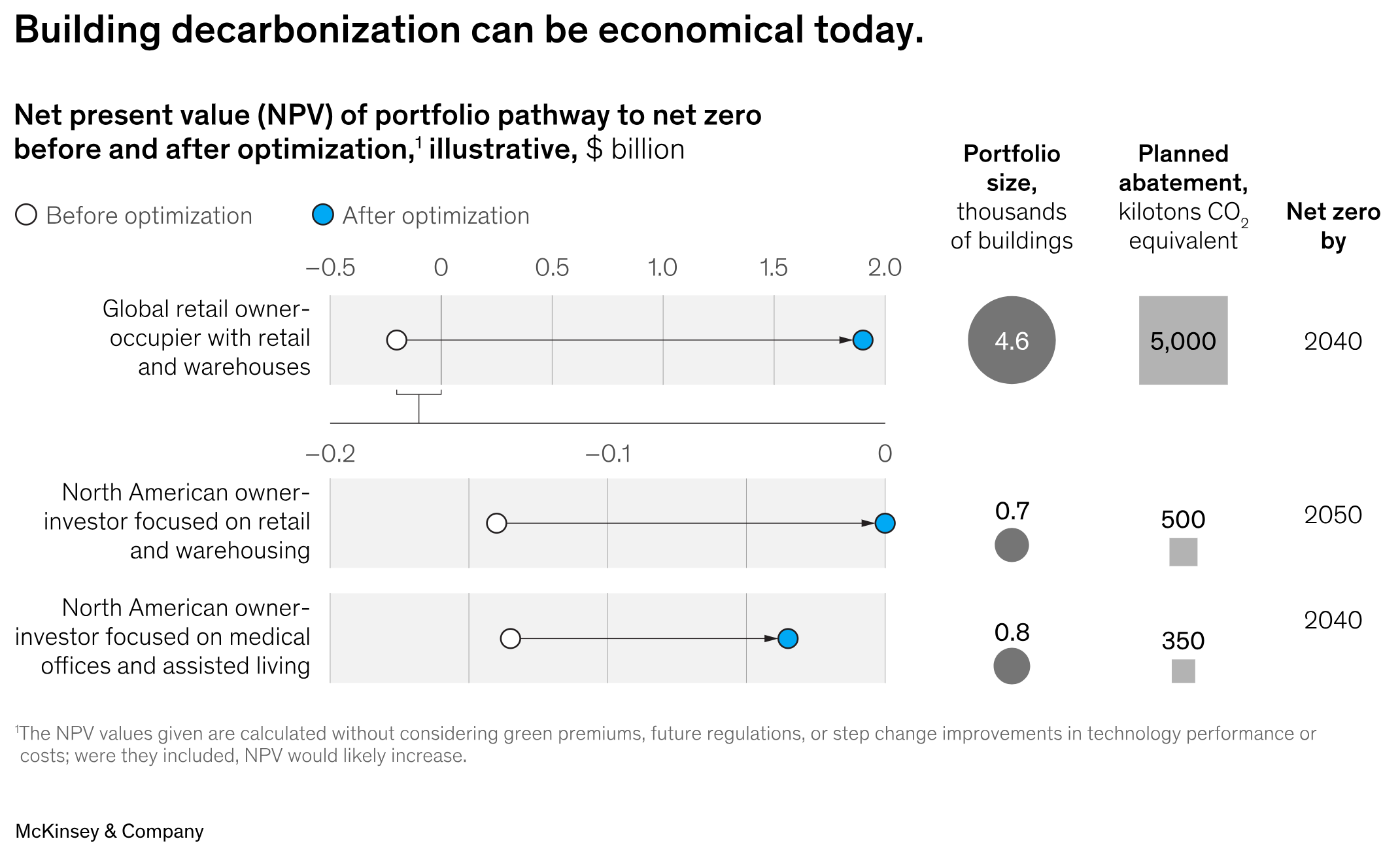

In a comprehensive McKinsey study on decarbonization efforts that encompassed around 20,000 buildings, surpassing 15 megatons of annual CO2 equivalent emissions, and spanning diverse property types and locations, it was found that real estate portfolios can often attain net-zero status with returns on investment ranging from neutral to positive. This outcome holds true even under stringent criteria, such as the absence of green premiums on rent or property valuation, the exclusion of potential future regulations or carbon pricing, and the absence of updated technology.

Implementing energy efficiency and electrification measures for each building's complete journey to net zero, along with optimizing renewable power procurement at the portfolio level, enables building owners and occupants to recover their investments through energy savings, capital cost optimization, and the avoidance of existing regulatory penalties.

Further, according to the study, it is estimated that an American investor in real estate managing approximately $20 billion in assets can formulate decarbonization plans for over 750 buildings (without regard to property type). Creating initial plans can be done in under eight weeks, resulting in a substantial enhancement of the net present value (NPV) of the trust's net-zero trajectory by approximately $85 million, approaching a nearly neutral NPV. The prospective self-sustainability of this investor's net-zero progression is sourced from the lack of utility expenses, avoidance of regulatory penalties, and a reduction in capital costs due to bulk procurement pricing. Introducing a carbon pricing mechanism or incorporating green premiums would yield positive returns over time.

MACC Versus ML Approaches

In the past, Marginal Abatement Cost Curves (MACC curves) have been used to identify then subsequently prioritize projects based on the average industry costs or savings per ton of carbon abated. They are effective in standardized industries but may not be optimal for real estate portfolios.

For instance, consider a building following a typical commercial building MACC curve, resulting in a negative Net Present Value (NPV) of $1.1 million to achieve net zero. However, an optimized approach using data and analytics, considering building specificities, could lead to a positive NPV of $100,000 for the same building, marking a $1.2 million improvement compared to the MACC method.

The limitation of the MACC approach lies in its inability to account for site-specific details and coordination opportunities between decarbonization strategies. This oversight can postpone action, leading to real estate owners implementing more expensive initiatives later on, which wastes capital and forfeits energy savings.

Methods of Improving NPV to Net-Zero

Many subsets of the real estate industry, such as commercial properties, are reaching an inflection point as hybrid work is on the rise in a post-pandemic world. Advanced technologies such as AI and cloud computing are being increasingly integrated into prioritizing sustainability of these buildings. To navigate these changes successfully, it's crucial for the real estate sector to develop clear digital strategies that address the root issues faced by clients and businesses.

While creating a foundational transformation strategy is essential, incorporating advanced technologies like AI and machine learning can bring significant efficiencies to the entire real estate process. These powerful tools enable a shift towards data-driven decision-making, from predicting potential issues with assets to improving overall operational efficiency.

Automatic Power Management

AI has the potential to learn from patterns and the daily habits of occupants to make predictions about when electronics are no longer in use, and automatically shut off their power supply. Software and hardware that autonomously controls lighting, heating, and cooling systems can lead to a reduction of 20% or more in a building's annual energy consumption.

This does require that the building have the necessary data collection equipment to build the machine learning. Data from a wide range of sources is needed, and will usually require sensors to be installed, as well. Only about 10-15% of buildings have the data collection infrastructure necessary to power AI systems. Buildings that do not have advanced management systems can instead use low-cost sensors for lighting and cooling functions.

Asset Specification

For better financial results, using generic lists of fixes, standard solutions, and cost curves isn't enough. To get the most out of decarbonization investments, each building needs an individualized plan. This is where machine learning can take in a building’s unique characteristics and synthesize an action plan that eases integration of green systems. This plan should take into account specific factors like the building's current state (insulation, equipment, layout), external conditions (local climate, geography, sunlight), and unique aspects like lease terms, tenant mix, and operational goals.

Machine learning can analyze leases to find templates to support capital recoveries for investments, leading to energy savings for tenants. This helps landlords synchronize costs and benefits between parties, preventing the "split-incentive problem." In situations without service agreements, landlords might consider implementing metered-efficiency structures, enabling them to receive a portion of the energy savings.

Avoiding Stranded Capital

The idea of "stranded assets" previously appeared purely abstract, almost exclusively discussed by climate advocates and forward-thinking investors. It suggested that climate change could potentially erase trillions of dollars in corporate value, transforming assets into liabilities. A stranded asset refers to something, like equipment or resources, that could be used to generate income but has lost its worth, typically due to external changes such as shifts in technology, markets, or societal habits.

To mitigate stranded capital, landowners should use machine learning to align short term capital investments throughout the portfolio with long-term decarbonization goals. Given that roofs and significant equipment typically have lifespans of 10 to over 25 years, failing to electrify at the end of their life expectancy could lead to stranded capital or necessitate premature retirement of equipment before reaching the end of its useful life.

Takeaways

With the growing prevalence of climate change generating an exigence of sustainable development, real estate is at the frontier of it. Utilizing artificial intelligence can incorporate energy-efficient upgrades and electrification initiatives for individual buildings and refine the acquisition of renewable energy at the portfolio level. This allows building owners and occupants to recover their initial investments and realize substantial benefits.

Part of these benefits include the increased profitability of buildings designed to be both smart and sustainable. Jones Lang LaSalle, a global manager of billions of square feet in commercial real estate, is strategically investing in AI systems to assist companies in reducing emissions. The rationale behind this initiative lies in how environmentally conscious buildings command higher rental rates and spend less time on the market. JLL anticipates a significant market shift, predicting that 56% of organizations will be willing to pay a premium for sustainable spaces by the year 2025.

As a result, these significant energy savings optimize capital costs. Moreover, it serves as a proactive measure, preventing potential regulatory penalties associated with inefficient energy usage. Through these combined efforts, stakeholders can ensure a more sustainable and economically viable trajectory for their buildings.

Works Cited

Amarnath, N. (2023). AI-driven approaches can expedite building decarbonization: McKinsey. Facilities Dive. https://www.facilitiesdive.com/news/ai-tech-building-decarbonization-sustainability-mckinsey/701299/

Boland, B et al. (2023). A new way to decarbonize buildings can lower emissions—profitably. McKinsey & Company. https://www.mckinsey.com/industries/real-estate/our-insights/a-new-way-to-decarbonize-buildings-can-lower-emissions-profitably#/

European Commission. (2023). Energy Performance of Buildings Directive. https://energy.ec.europa.eu/topics/energy-efficiency/energy-efficient-buildings/energy-performance-buildings-directive_en#documents

Holger, D. (2023). Artificial Intelligence Steps In to Lower Carbon Footprint of Buildings. Wall Street Journal. https://www.wsj.com/articles/artificial-intelligence-steps-in-to-lower-carbon-footprint-of-buildings-4efa517f

Jones, J., and J.K. O’Hara (Eds), 2023. Marginal Abatement Cost Curves for Greenhouse Gas Mitigation on U.S. Farms and Ranches. Office of the Chief Economist, U.S. Department of Agriculture, Washington, DC

Kelly, J et al. (2022). The commercial case for making buildings more sustainable. Jones Lang LaSalle (JLL). https://www.us.jll.com/en/trends-and-insights/research/the-commercial-case-for-sustainable-buildings#form

Makower, J. (2019). The growing concern over stranded assets. GreenBiz. https://www.greenbiz.com/article/growing-concern-over-stranded-assets

Morphy, E. (2018). How AI Is Being Used to Read Leases, Other Real Estate Documents. GlobeSt. https://www.globest.com/2018/04/24/how-ai-is-being-used-to-read-leases-other-real-estate-documents/

Naval Facilities Engineering Command (NAVFAC). (2021). Design-Build Design-Bid-Build Multiple Award Construction Contract (MACC) North Area of Responsibility. HigherGov. https://www.highergov.com/vehicle/design-build-design-bid-build-multiple-award-construction-contract-macc-north-area-of-responsibility-5133/#contract_awards

Nyangon, J. (2021). Tackling the Risk of Stranded Electricity Assets with Machine Learning and Artificial Intelligence. IntechOpen. doi: 10.5772/intechopen.93488

Prime Minister’s Office. (2023, September 20). PM recommits UK to Net Zero by 2050 and pledges a “fairer” path to achieving target to ease the financial burden on British families [Press release]. https://www.gov.uk/government/news/pm-recommits-uk-to-net-zero-by-2050-and-pledges-a-fairer-path-to-achieving-target-to-ease-the-financial-burden-on-british-families

United Nations Environment Programme (2022). 2022 Global Status Report for Buildings and Construction: Towards a Zero‑emission, Efficient and Resilient Buildings and Construction Sector. Nairobi.

U.S. Securities and Exchanges Commission. (2022, March 21). SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors [Press release]. https://www.sec.gov/news/press-release/2022-46