Hertz Quarter Three: Post-Covid Car Rental

On October 27, 2022, Hertz reported Q3 total revenue of 2.5 billion, a significant boost compared to the 1.8 million in quarter 1. Looking back now at the close-to-bankruptcy statistics in 2020, the continued increase in Hertz’s revenue seems to indicate an end to the apocalypse in post-covid car rental businesses.

The Apocalypse

Hertz, along with Avis and many other victims of the pandemic, filed for bankruptcy in May 2020. Debts were sky-high, and disruptions in the supply chains of cars made the rental business tough to operate. These eventually led to high prices across states, from $300 to $500, pushing the business to a harsher position. However, Hertz managed to take advantage of the shortage and regained its budget by selling second-handed cars. Stock prices went from $15 before the pandemic to $2 at a very low, and eventually back to $9 by the end of 2020.

Back on track…and going forward?

Now we’re approaching 2023, Hertz’s steady increase in revenue seems to imply a steady back-on-track. To achieve steady financial growth, Hertz made moves to expand its international markets to Canada and introduce membership plans for loyal customers. Introducing more point systems and reward programs such as the Hertz Gold Plus Rewards by the end of 2021, a capital increase was evident. In order to encourage more retention, car rental companies are polishing websites and utilizing smartphone apps to smoothen the online booking process. With the development in tech, companies like Alvis are also partnering up with Ford and taking advantage of software development to drive further growth in the market.

https://www.fortunebusinessinsights.com/car-rental-market-105117

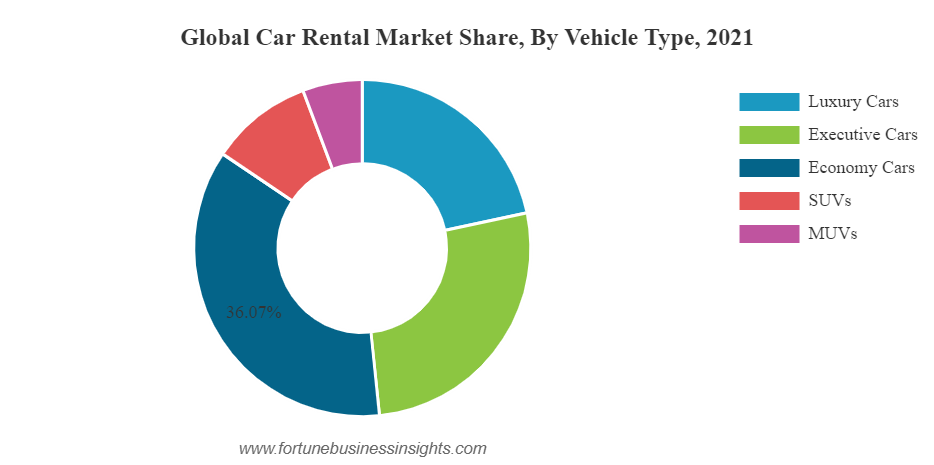

Changes in the car-type segmentation also bring good news to the market. According to fortunebusinessinsights, the market segmentation includes “luxury cars, executive cars, economy cars, SUVs and MUVs”. Economy cars have always dominated the market with a 36.07% market share in 2021 with their high cost-effectiveness. However, global demands increased in the other four more premium and profitable vehicle types thanks to the fast economic growth in developing countries.

Behind the satisfying statistics lies problems, though. Current Hertz prices can still be less affordable than Uber and Lyft, and the layoff during covid persists in affecting the industry’s work efficiency. Albeit the good-looking total revenue boost, subtle challenges still lie in Hertz’s path of recovery and its long battle under the pandemic-altered economy. The seasonal nature of the industry and the nature favor towards tier 1&2 cities both indicate uncertainty. The decline in airlines would also affect tourism and hit the rental car market. Long-term risks also include the increase in post-covid crude oil prices, a decrease in wages, and developing public transportation.

Sources: (not-yet MLAed)

1 https://www.nytimes.com/2021/06/30/business/hertz-bankrupcty.html

2 https://www.autorentalnews.com/10162953/is-hertz-back-on-track

3 https://www.autorentalnews.com/10169141/hertz-boosts-q1-revenue-40

4 https://www.caranddriver.com/news/a36921952/hertz-exits-bankruptcy-2021/

5 https://www.caranddriver.com/news/a36085266/rental-car-shortage/

6 https://ir.hertz.com/static-files/1c396efc-4000-48b8-8145-395c05ef2cb1

7 https://www.fortunebusinessinsights.com/car-rental-market-105117