The Potential of the Carbon Fee and Dividend System in Addressing Climate Change

GRC 2023 Global Essay Competition Top 10

By Pham Tran Bao Chau

Summer 2023 has broken existing records for heatwaves, wildfires, and many other natural disasters. Scientific reports all point toward climate change and excessive greenhouse gas emissions. While various policies and measures aimed to address these issues, they are not effective due to a lack of public support.

Currently, the two most common systems, carbon tax and carbon credit, have severe limitations: Carbon tax systems are evaded through greenwashing and tax loopholes. Carbon credits or emissions trading systems favor large corporations, allowing them to fake carbon emission reports or buy credits given their large funds, which defeats the goal of reducing fossil fuel consumption. Most importantly, both systems hike up fossil fuel costs and negatively affect the lower-income households who bear the brunt of consumption tax, causing negative public sentiments. Worse, the lack of transparency in tax money allocation also fuels distrust.

To address these shortcomings, the carbon fee and dividend system emerges as a promising solution that balances economic growth, resource consumption, and wealth distribution, all while contributing to sustainability.

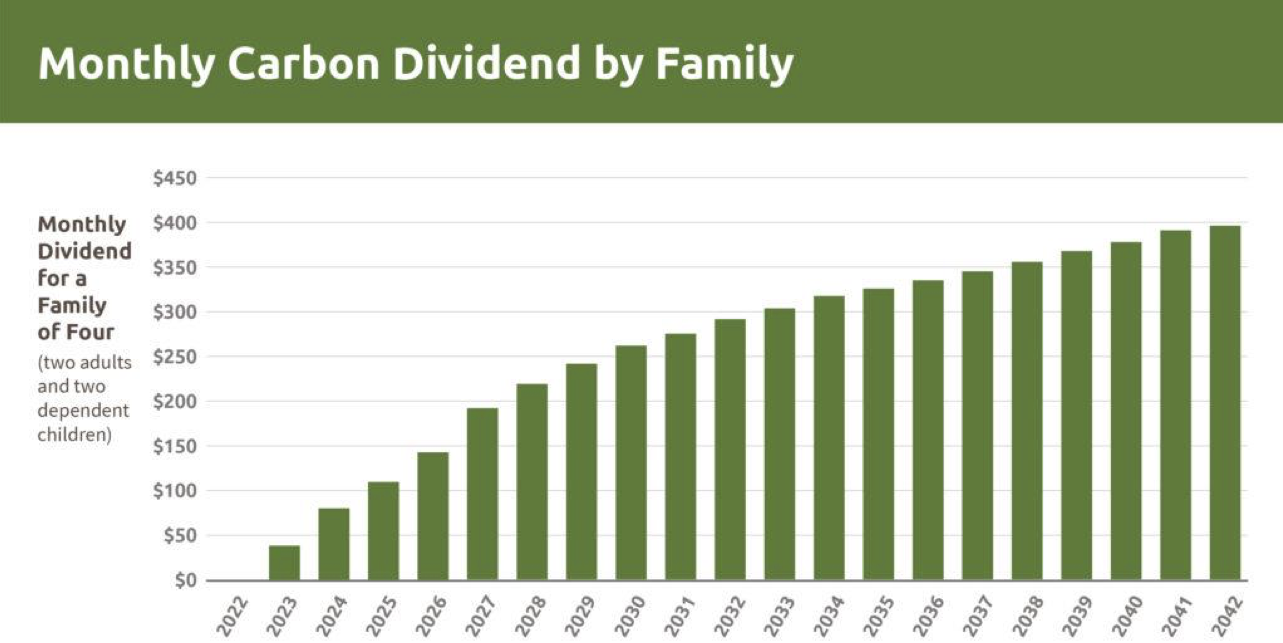

Essentially, this system proposes that instead of the carbon tax going into community programs and subsidies, it would go directly to the citizens, such as through tax reduction, health insurance discounts, or direct annual payments. This solution keeps the advantages of the carbon tax, discouraging carbon emissions and generating funds for green alternatives, while tackling public discontent. Since this policy is quite novel, only three countries--Austria, Switzerland, and Canada--have adopted a variation of this system so far, whereas 27 countries have adopted carbon tax and 25 have adopted carbon credit system. Nonetheless, in those three countries, since this system offers tangible benefits, public attitudes toward the green transition and climate movement are more favorable. In Austria, for example, residents receive a yearly "climate bonus" ranging from 100 to 200 euros. Implementing a similar system in the U.S. could result in annual returns of approximately 2,000 USD per person (Figure 1). The rebates would offset the increased energy costs for most households (Figure 2). Consequently, this policy could potentially foster a positive attitude toward green reforms and incentivize support for movements, such as buying environmentally friendly alternatives. Although bureaucratic logistics may emerge as a concern, the proposed system shares similarities with existing pandemic relief distribution mechanisms that most governments deploy; therefore, it may alleviate some logistical challenges of implementing the new system. Eventually, this policy has the potential to shift economic trends to a more sustainable direction.

With equity and tax progressivity in mind, the amount of dividend could be proportional to the individual or business tax bracket, with a gradual rise in the carbon tax rate to accommodate the transition. Furthermore, the policy should offer options to donate dividends to environmental campaigns and higher dividends for those adversely affected by the green transition to reduce negative public sentiments toward the shift to a greener workforce. The government must also continue subsidizing green alternatives and green tech industries to ease the transition. For instance, the Swiss government redistributes most of its tax revenue to citizens and invests the rest in green technology.

To examine the policy’s efficiency on a global scale, it is crucial to ensure its effectiveness in the most polluting nations: the US, China, and India. According to the IMF Working Papers 2022, China already has a carbon exchange trading system, making the implementation of the proposed policy feasible. Although carbon tax would be regressive in China, the dividends would more than compensate for lower-income households. Meanwhile, in India, the carbon tax burden would be relatively marginal, and rebates “would cost India only a quarter of its carbon revenues to make half of its households better off”, thereby lowering the wealth gap as well. Likewise, in the U.S., the introduction of the Energy Innovation and Carbon Dividend Act in 2019 showed potential to bring progress to the climate movement, especially since the U.S. shares a similar geopolitical and economic landscape to Canada.

On a macroeconomic level, the carbon fee and dividend policy would potentially reorient the economy toward more sustainable growth, promoting a more environmentally conscious resource consumption pattern by utilizing renewable sources, and supporting lower-income individuals who are most affected by climate change consequences, thus balancing wealth distribution. Furthermore, public sentiments toward climate-conscious policies would significantly improve since people would derive direct monetary benefits. In turn, they might even spend some portion of the dividend on purchasing more sustainable alternatives, thus aiding their personal lifestyle transition to a greener one. Overall, a carbon tax and dividend system seem to be the best nationwide solution for a sustainable and equitable future.

References:

Alonso, Cristian, and Joey Kilpatrick. “The Distributional Impact of a Carbon Tax in Asia and

the Pacific.” IMF Working Papers 2022, no. 116 (June 10, 2022).

https://doi.org/10.5089/9798400212383.001.A001.

Animalia. “Has the Amazon Rainforest Crossed a Breaking Point? – Animalia.”

Joinanimalia.com, 2021. https://joinanimalia.com/has-the-amazon-rainforest-crossed-

a-breaking-point/.

Congress.gov. “H.R.763 - 116th Congress (2019-2020): Energy Innovation and Carbon

Dividend Act of 2019,” 2019. https://www.congress.gov/bill/116th-congress/house-

bill/763.

Environment and Climate Change Canada. “Government of Canada Launches the Quarterly

Climate Action Incentive Payment for 2022‒23.” Canada.ca. Government of Canada,

July 5, 2022. https://www.canada.ca/en/environment-climate-

change/news/2022/07/government-of-canada-launches-the-quarterly-climate-action-

incentive-payment-for-202223.html.

Friedrich, Johannes, Mengpin Ge, Andrew Pickens, and Leandro Vigna. “This Interactive

Chart Shows Changes in the World’s Top 10 Emitters.” World Resources Institute,

2023. https://www.wri.org/insights/interactive-chart-shows-changes-worlds-top-10-

emitters.

International Carbon Action Partnership. “Emissions Trading Worldwide: 2022 ICAP Status

Report,” March 29, 2022. https://icapcarbonaction.com/en/publications/emissions-

trading-worldwide-2022-icap-status-report.

Jacoby, Henry D. “There’s a Simple Way to Green the Economy – and It Involves Cash

Prizes for All.” the Guardian. The Guardian, January 5, 2021.

https://www.theguardian.com/commentisfree/2021/jan/05/simple-way-green-economy-

cash-prizes-carbon-dividend.

Lai, Olivia. “What Countries Have a Carbon Tax?” Earth.org, September 10, 2021.

https://earth.org/what-countries-have-a-carbon-

tax/#:~:text=There%20are%20currently%2027%20countries,%2C%20the%20UK%2C

%20and%20Ukraine.

Lee, Mike. “Booming Offset Industry Could Cut CO2 -- or Just Line Pockets.” E&E News by

POLITICO, May 2, 2022. https://www.eenews.net/articles/booming-offset-industry-

could-cut-co2-or-just-line-pockets/.

Mildenberger, Matto, Érick Lachapelle, Kathryn Harrison, and Isabelle Stadelmann‐Steffen.

“Limited Impacts of Carbon Tax Rebate Programmes on Public Support for Carbon

Pricing.” Nature Climate Change 12, no. 2 (January 24, 2022): 141–47.

https://doi.org/10.1038/s41558-021-01268-3.

Mufson, Steven. “The Fastest Way to Cut Carbon Emissions Is a ‘Fee’ and a Dividend, Top

Leaders Say.” Washington Post. The Washington Post, February 13, 2020.

https://www.washingtonpost.com/climate-environment/the-fastest-way-to-cut-carbon-

emissions-is-a-fee-and-a-rebate-top-leaders-say/2020/02/13/b63b766c-4cfc-11ea-

bf44-f5043eb3918a_story.html.

NASA. “NASA Announces Summer 2023 Hottest on Record - NASA,” September 14, 2023.

https://www.nasa.gov/news-release/nasa-announces-summer-2023-hottest-on-

record/.

Nuccitelli, Dana. “Canada Passed a Carbon Tax That Will Give Most Canadians More

Money.” the Guardian. The Guardian, October 26, 2018.

https://www.theguardian.com/environment/climate-consensus-97-per-

cent/2018/oct/26/canada-passed-a-carbon-tax-that-will-give-most-canadians-more-

money.

Oxford Martin School. “Carbon Dividend from Polluters to Households Could Win over the

Public,” 2018. https://www.oxfordmartin.ox.ac.uk/news/201807-carbon-pricing/.

Shultz, George P. “Shultz and Becker: Why We Support a Revenue-Neutral Carbon Tax.”

WSJ. The Wall Street Journal, April 7, 2013.

https://www.wsj.com/articles/SB10001424127887323611604578396401965799658.

Snell, Stuart. “New Carbon Dividend Proposal Gets Community Support.” UNSW

Newsroom, December 2019. https://newsroom.unsw.edu.au/news/business-law/new-

carbon-dividend-proposal-gets-community-support.